Much of the material here originates from a webinar I ran for the CFA Society of the UK in February 2020 titled “Risk Management in a Changing Market Landscape”.

Volatility has changed

Looking at the average levels of volatility is deceiving and does not tell you about a crucial factor – the distribution of volatility.

Below is a chart of the VIX Index before the recent crisis unfolded, with the distribution of pre, during, and post crisis below.

Focussing on just the “pre” vs “post” crisis areas, what is clear to see is that whilst the average levels of VIX are similar, the distribution post crisis exhibits a much fatter tail.

The four drivers of change

There have been four key changes since the crisis that have driven the changes we see in market behaviour today

Bank Regulation

Bank Holding Companies with >500bn in assets now hold approx. 12% CET 1 as a percent of RWA vs approx. 4% and 9% T1 capital as a percentage of average total assets vs 5% during the financial crisis 1

Shift to Passive Funds

In August 2019, assets in index tracking US equity funds surpassed those managed actively for the first time 2

Algo / Electronic Trading

Over 20% of FX spot and nearly 70% total trading volumes in developed stock markets is now from Algo trading

Demand for Collateral

Regulation requiring banks to hold HQLA, mandatory clearing, and uncleared margin rules have substantially increased the quantum of collateral/liquid assets required

The impact to markets

These drivers have created significant changes to how the financial markets, and the participants within, behave.

Banks no longer at as shock absorbers to the market given that there is less risk capacity at banks.

Everyone tries to do the same thing at the same time as a result of the shift to passive fund management and to electronic trading.

There is less liquidity in assets due to securities being encumbered due to regulatory changes.

In simple terms, asset prices move quickly and they move a lot.

The big liquidity mismatch

One of the biggest learnings to come out of the financial crisis of 2007/2008 and the driver for the regulators to focus on NSFR (Net Stable Funding Ratio) and LCR (Liquidity Coverage Ratio) was the mismatch in duration between the asset and liability side of bank balance sheets and the inability of banks to be able to raise cash by liquidating assets on their balance sheet.

What we are seeing in today’s market is a mismatch in liquidity between the investor and investment side in fund management. Whilst the underlying assets may take a significant amount of time to liquidate, investors are still within their rights to redeem their cash in a fraction of the time.

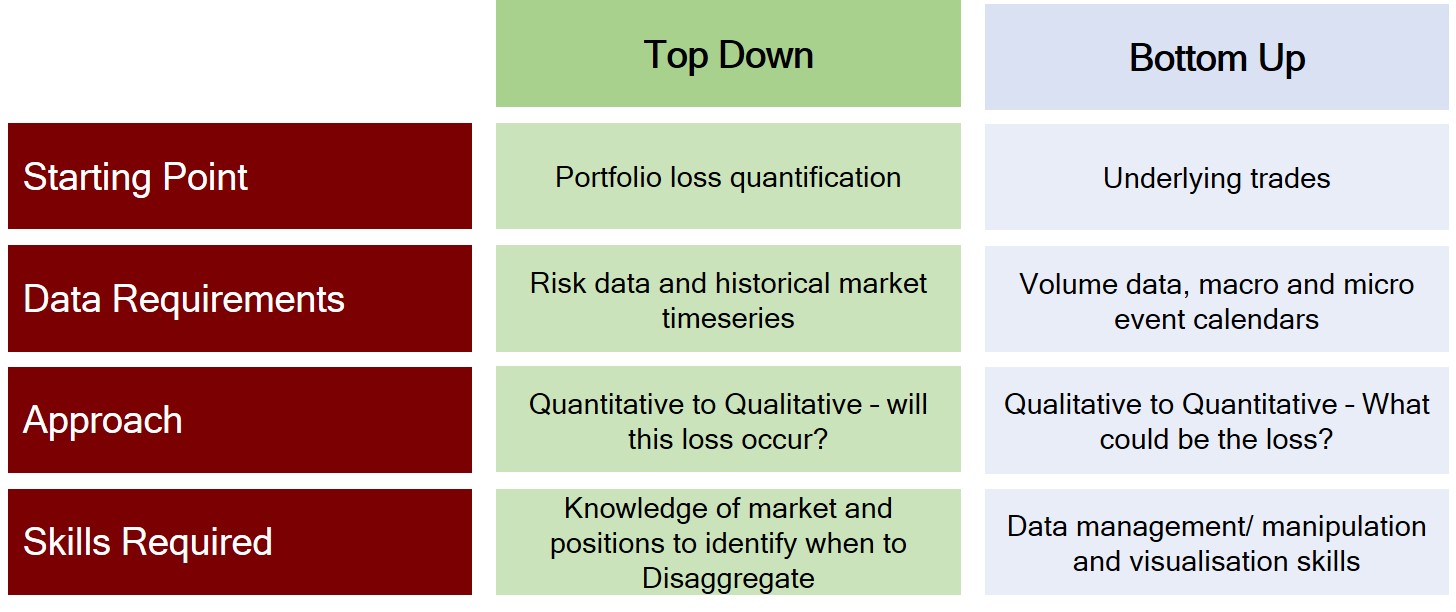

What we also still see is a focus on traditional top down risk management, and not enough investment into bottom up, data driven risk management approaches.

The challenge for traditional risk management

Traditional risk management requires aggregation of risk before processing it against historical data or scenarios to estimate potential losses which relies on either an event to have happened in the past or the ability of the risk manager to construct an appropriate future scenario.

Risk also needs to be disaggregated based on the expert judgement of risk managers to capture the impact of basis risk

In an environment where liquidity drives market prices over fundamentals, the traditional approach to risk management faces considerable headwinds.

In an environment where data readily is available, a bottom up approach to risk management really shows its strengths.

Bottom up risk management begins with underlying position / trade data which is augmented with additional data for example, liquidity or volume data. Data is then processed into visualisations which are used to highlight key risk positions, and potential losses are estimated by risk managers using scenarios and historical data for these positions.

Wrapping up

The market looks and behaves fundamentally different to how it did pre-crisis. Lightning will continue to strike wherever there is a liquidity mismatch, and we will continue to see the words “the biggest move in history” appear over and over again.

Risk management techniques have to evolve to this new normal, and new approaches have to be used in tandem with traditional approaches. Relying on approaches such as VaR when it is the lack of liquidity that is driving moves is like standing under a tree in the middle of a thunderstorm.

Finally, I suspect regulators will focus a lot more on the mismatch in liquidity between the investor and the invested assets in much the same way that banking regulation focussed on the mismatch between the asset and the liability side of the balance sheet and the inability of banks to be able to liquidate assets during the financial crisis.

Please contact us if you would like to understand more

1 John Walter – US Bank Capital Regulation: History and Changes Since the Financial Crisis